Our Impact

Vision

Our vision is to make it cheaper and easier for people globally to access microfinance services and financial education utilizing technology.

Boost’s impact has been recognized by:

Here’s what we’ve learned about maximizing impact:

- Make financial services and education interactive and convenient. Our solution is an end-to-end digital financing experience. We start with a chatbot credit application in which even informal entrepreneurs can build a P&L in a way that’s intuitive for them. Within 10 minutes they have a dynamic loan offer based on their profile. We do tech enabled-KYC and the result is a validated, low risk loan.

- Build a process that is inherently high inclusion: work within messaging apps that clients already know how to use, so there’s no additional tech barrier to entry, and application is 24/7. The process is convenient and 100% of clients surveyed say their next loan will be digital.

- Be entrepreneur enabled: Design for entrepreneurs in process and also loan product: our tech enables loans from $25 - $04k, calibrated to local market demand for business building capital.

- Digital = learning from data: the digital process also allows us to built a huge data pool to constantly improve financial products, underwriting, and targeting

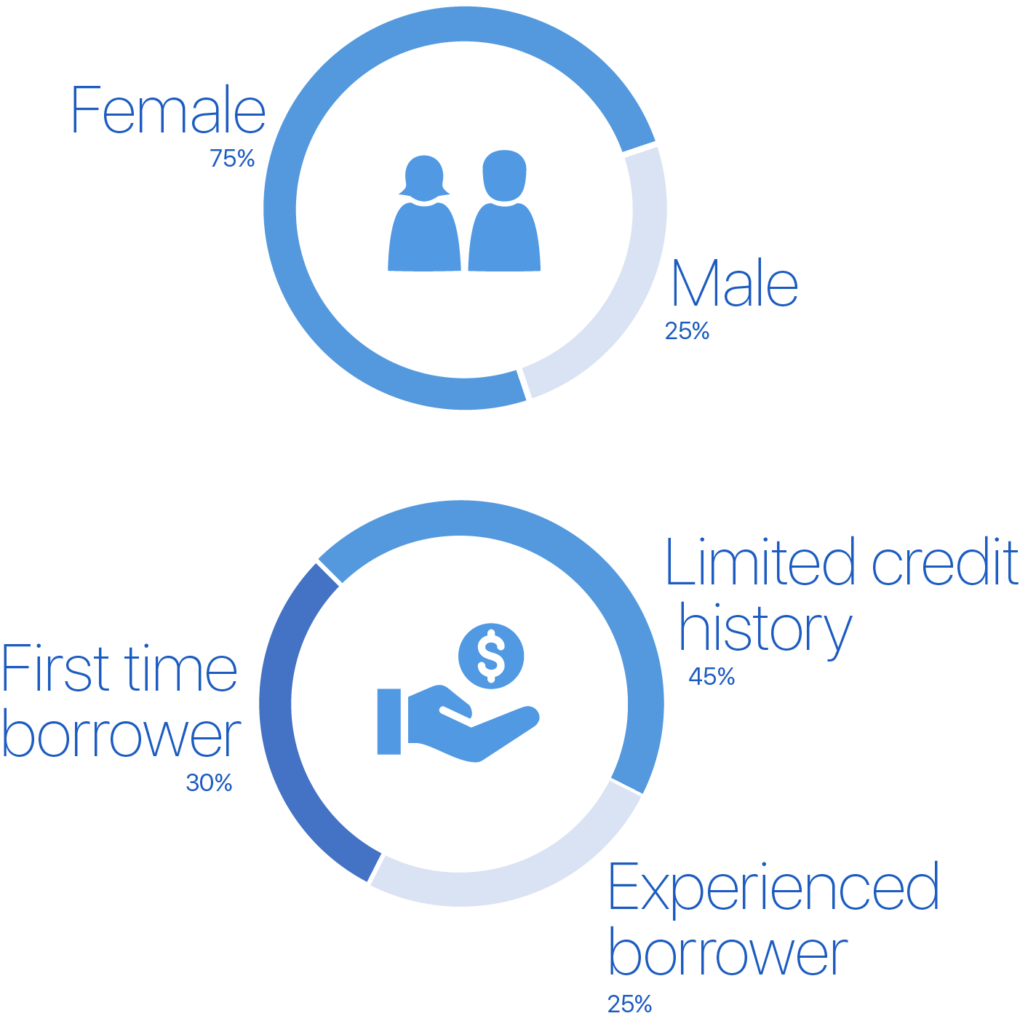

We enable unbanked and underserved customers to expand income generating activities

ACCESSIBLE

1.7 days of customer time saved per loan

INTENTIONAL

Promoting income-generating financing

EDUCATIONAL

20,000 clients accessing financial education