With Boost+Oradian, RAFI Microfinance unlocks unparalleled customer reach and responsiveness.

We love it when a plan comes together! In early 2024, Boost CEO Gordon Peters and Oradian CEO Antonio Separovic came up with an idea: marry Boost’s wide-reaching whitelabeled chat-based onboarding technology with Oradian’s flexible and integration-ready cloud-native core banking platform, Instafin, to create an out-of-the-box offering for financial service providers to enable end-to-end digital onboarding, approvals, and account management. Or, to explain it more simply:

Why? Because it solves several problems for the financial service providers that both Boost and Oradian serve:

Financial Institutions need tech to help them reach new customers and serve existing customers better, and Boost provides this through Messenger, Viber, and Whatsapp — meeting customers where they already are.

Financial institutions don’t want to use valuable IT resources integrating new systems, or Operations Team time on learning new platforms for customer management, when they could be allocating those resources to grow their business and serve customer needs: by integrating directly with Oradian’s Instafin core banking system, the bank can manage new applications with their existing backend, instantly.

In a competitive field, Financial institutions need nimble tech that lets them experiment quickly and easily to constantly improve their product offerings, underwriting, and customer experience, faster and better than the competition: end-to-end integrated systems avoid data silos that slow down learning and experimentation, and advanced business insight analytics and quick-to-implement experiments enable constant funnel improvements

And we like to move fast: within weeks Boost launched chat-based onboarding for RAFI Microfinance, which serves micro-entrepreneurs in the Philippines. Thanks to RAFI’s use of Oradian’s highly adaptable and integration-ready core banking system, we were able to integrate quickly. This is how it works:

An entrepreneur starts a chat with RAFI, powered by Boost tech. There’s no app download required because it works through the same chat channels she’s used to.

Within minutes she receives a preliminary loan offer, based on RAFI’s product underwriting criteria, tailored to her.

She scans her ID and takes a selfie, which allows us to confirm her identity, with A.I. powered fraud detection.

She uploads supporting documents to complete her application.

Now, thanks to the integration between this onboarding channel and RAFI’s core banking system, Instafin (Oradian) the application is seamlessly uploaded for RAFI’s team, following the same workflows they already use.

RAFI’s approval can be fast and efficient.

The entrepreneur gets to use the same systems she already understands: Facebook Messenger chat and her phone camera. The RAFI Microfinance team got to use the same core banking platform as usual.

Technology facilitated the easiest onboarding process possible, instead of creating new tech headaches!

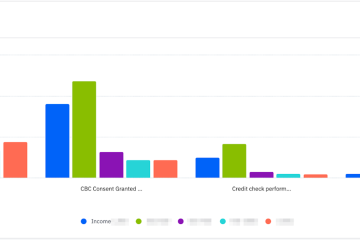

And RAFI’s team can monitor the whole process through their own data dashboard, which allows them to constantly improve their product offerings and underwriting.

RAFI CEO Tom Kocsis said, “We’ve been super happy with how easy it was to launch this, and the initial results are impressive. Boost and Oradian gave us an out-of-box solution to offering digital onboarding. We didn’t have to spend a year developing a custom tech solution – Boost, after some simple configuration to our own workflow requirements, had us live with digital applications within weeks. Since we use Instafin for core banking already, there was no integration work for my team.”

With a fully digitized process, RAFI is equipped to scale its operations and extend financial services to underserved communities with greater efficiency. As we said, we love it when a plan comes together!

0 Comments